Four ways to improve deep tech startup funding

Over the past six installments, the Bridging the Valley article series has explored obstacles on the road of hardware development that often prevent the productization of new technologies, causing a phenomenon called the “Valley of Death.” We’ve covered quite a broad sweep of topics, but the term was originally used to describe the specific difficulty of obtaining funding during the proof-of-concept phase of development. In one of our previous articles, we discussed why finding funding for a startup based on a completely new technology (a “deep tech startup”) is so difficult. Now let’s discuss what should be done about it.

Looking at funding models

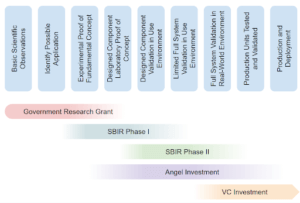

In the present ecosystem, there are different kinds of funding, and because of their pros and cons, they each complement each other along various points of the technology development process. Capital typically comes either from government grants, loans, business sales, or dilutive funding (such as angel investment or venture capital). Non-dilutive funding is preferred, since the founders don’t need to sell part of their company in order to receive it. Loans can be difficult for deep tech to acquire because of the high risk.

It’s also possible to generate revenue even if the technology isn’t yet ready to sell, generally by selling the deep level of expertise of the team through consulting. The tradeoff is that the bandwidth of the team members must be used to generate revenue through consulting, and for however much time they provide services to clients, or invest into the infrastructure to support those consulting offerings, it directly reduces the hours they have available to develop their product.

As we discussed in our previous article, the bureaucratic difficulties and long, 6-month timelines between applying for and receiving the award of a Small Business Innovation Research (SBIR) grant cause huge business risks to any company relying on these grants for funding. Companies should take advantage of government grants, but should diversify their funding once the technology is developed enough to do so.

Venture capital and angel investing aren’t infallible either. Most venture capital firms are poorly set up to invest in new deep tech, especially those in hardware. Many operate assuming their investments will pay out in 5 years, while hardware technologies can take 5–10 years to productize. Furthermore, any investment requires an understanding of what the investor is putting their money into. Many of these technologies require deep, specialized knowledge to understand the risks of the investment. Most investors deal with a wide breadth of investments, and don’t have this specialized knowledge. The unknowns are much greater for them, and the risk is therefore much greater, leading to less willingness to invest capital.

Exploring creative solutions

So how can we improve the ecosystem? Here are four approaches that could help.

1. Improve existing grant programs

The SBIR program can be improved. The timelines for the SBIR application evaluation need to be substantially reduced in order for them to enable startups to productize without significant additional business risk. This is easier said than done, though, because of the way funds are managed and allocated within SBIR programs. It may require a major overhaul of how the SBIR programs operate.

2. Encourage more deep-tech-focused VC Firms

Not all VC firms are a poor match for deep tech startups — in fact, there are several VC firms that specialize in deep tech. They’re able to do so because they’re structured in a way that enables invested startups to have a longer development time than standard VC firms. They also bring on individuals with specialist knowledge, often PhDs in relevant industries, to help evaluate potential investments.

They can offer resources that are targeted at deep tech startups, which have very different needs from many other high-growth startup companies. Additionally, the partners of these firms are often deep tech founders themselves, and therefore understand the difficulties. An example is The Engine at MIT, which offers multiple programs for introducing researchers to the business world and provides lab space for startups in the community. Having more of these deep-tech-focused VC firms in the ecosystem would be a massive boon to closing the Valley of Death.

3. Re-envision government venture capital

The value of government venture capital (GVC) firms is a widely debated topic. Detractors argue that they crowd out private venture capital, while proponents claim that they augment and enable private venture capital by co-investing in companies. There’s evidence for both claims. The US does have one, In-Q-Tel, that focuses on companies that provide products or services that could be modified to serve various parts of the government. I’d propose that the GVC exist, but play a slightly different role from the standard VC firm.

Theoretically, the government should be providing funding when it enables the development of a public good that would otherwise not occur. This means that in an ideal world, government funds would help a deep tech startup de-risk their technology enough that it makes sense for private investors to begin investing. Although the SBIR is supposed to fill this funding gap, we’ve already discussed the problems with the program. A nonprofit GVC entity technically separate from the government focusing on very early-stage companies (almost acting as an angel investment group) might be more mobile than government grant funding, and therefore an effective way to augment the SBIR.

There are also some technologies that, due to the nature of the technology, are limited in their ability to capture the value that they create (meaning that even if they’re self-sustaining, they don’t appear to be profitable enough to be of interest to private venture capital), even if they’re hugely valuable to society. Various sustainability-focused companies might fall into this category, especially given the seesawing of major governments on environmental policy. These technologies should theoretically be fully funded by the government since they create enormous public good. A GVC that’s mission-driven and invests in the development of these kinds of companies could be very beneficial to society.

4. Offer government-sponsored venture capital

Another possibility is if the government were to make “impact investments” into existing private VC firms, where that investment is restricted and could only be invested into early TRL (technology readiness levels) companies that license and actively use intellectual property owned by government labs or universities. This would reduce overhead of bureaucracy while injecting capital into the early development cycles, without pushing out the existing private investment firms. However, I don’t know if this has ever been attempted, so the problems that this solution might encounter are entirely unknown. Additionally, this solution doesn’t improve the funding situation of technologies that create public good, but where innate properties of that technology make it difficult for the inventing company to capture that value.

These possibilities are promising methods for helping to bridge the funding Valley of Death while working within the current system of technology development. I’m sure there are other creative solutions out there, and I invite you to share your ideas in our Discord! In our next article, we’ll break out of the box and explore entirely new systems for bridging the technology Valley of Death.

informal is a freelance collective for the most talented independent professionals in hardware and hardtech. Whether you’re looking for a single contractor, a full-time employee, or an entire team of professionals to work on everything from product development to go-to-market, informal has the perfect collection of people for the job.